|

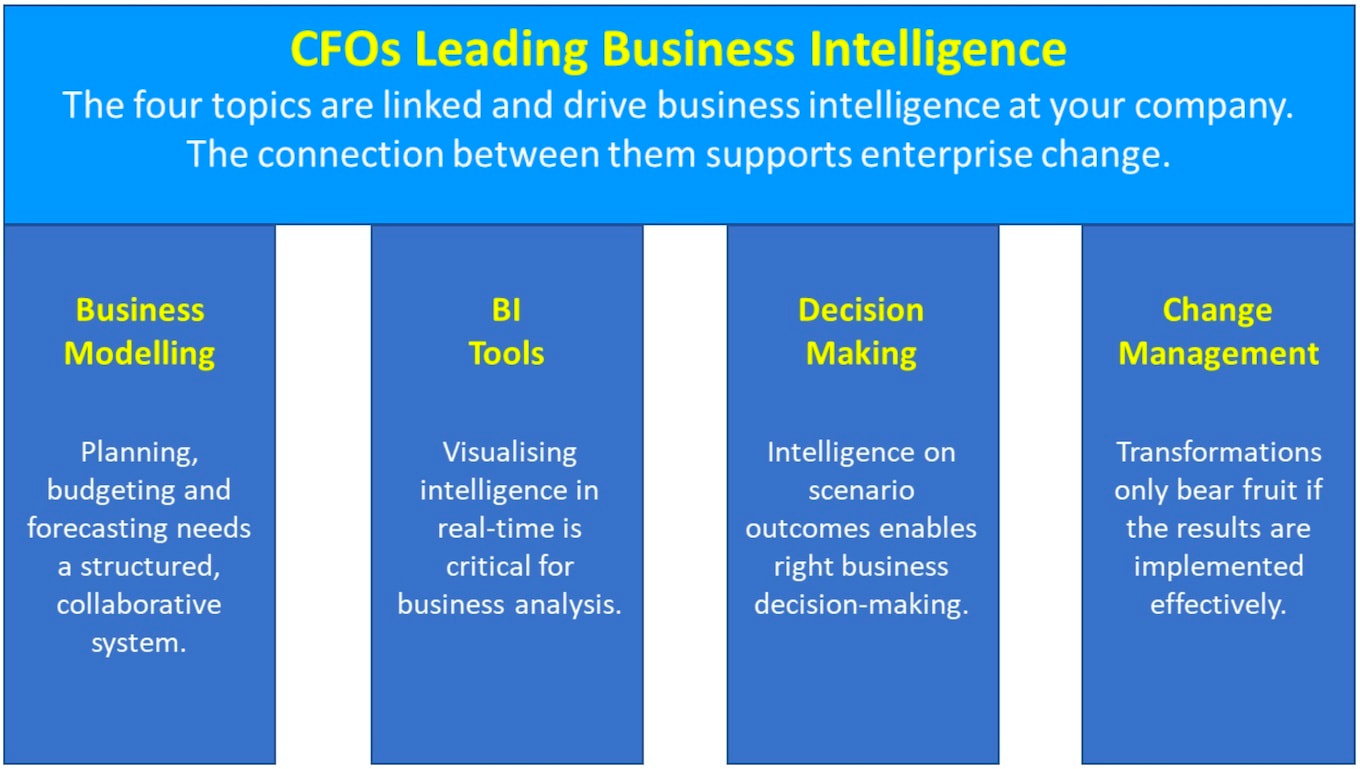

CFOs Leading Business Intelligence – Digital Workshop Series in 5 Parts | Q3-Q4 2021 In today’s business world, the markets are changing in an accelerated fashion; customers shift their preferences, supply chains are facing major challenges, and the workforce requirements are evolving. In this context, business intelligence covers a broad range of important topics. Whilst the topics individually are important, it is by connecting them and thinking about business intelligence holistically that CFOs can preside over a best-in-class process which is both effective and efficient. Overview Business Intelligence is central to a successful enterprise. Everyone in the enterprise is a stakeholder, and the CFO needs to consider many external people, including investors, involved in business operations. Different stakeholders have different needs from a business intelligence process, which encompasses planning, budgeting and forecasting. Planning is an opportunity for the enterprise to lay out its mid-term strategy and articulate the resources needed to achieve that. The budget is very often a detailed process to set targets and incentives for the year ahead. The forecast is mechanism to assess how the business is tracking against targets and to provide a framework for conveying the risks associated with business performance. Flexible and robust systems for business modelling are essential to support these processes. Excel on its own is not good enough, especially due to the need for collaboration across departments and for multi-dimensional modelling. A good business intelligence system will include metrics relating to the broader industry as well as non-financial KPIs already defined and tracked in incentive plans. Presentation of business intelligence is critically important, and many stakeholders may not be comfortable with large volumes of numbers. So, the CFO should connect dynamic dashboards and graphical interfaces to the business models to communicate the business intelligence clearly. At this point in the process the CFO and other stakeholders may well ask ‘so what’? If the business has produced all this excellent intelligence it must be used for making business decisions. This may not be as straight forward as it sounds. Even the best models may have wrong assumptions, errors, omissions and bias, which need to be considered in decision making. Some decisions are, naturally, routine. Others can be transformational or disruptive and, in these situations, change has to be managed for a smooth transition. It is not sufficient to implement a new system but to continue with legacy ways of working. Workflows need to be re-designed to get the most efficiency gains from change and staff need to be trained and developed to adjust to their new world. Specific tips for the four pillars of business intelligence are as follows. Business Modelling

Business Intelligence Tools

Decision Making

Change Management

Thanks to our presenters and panelists across the series! Originally posted on CFO Connex, the leading network for CFOs in Asia: Debrief: CFOs Leading Business Intelligence

0 Comments

Leave a Reply. |

Subscribe

Receive our monthly themed summaries of our thoughts: click! TimTim is a change practitioner in the area of innovation and excellence. He is working with teams to accelerate innovation, collaboration and agility. Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed